Max Compensation For 401k 2025. Compensation limit for figuring contributions: Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs.

Compensation threshold for key employee nondiscrimination testing: In 2025, the limits were $66,000, or $73,500 for people 50 and older.

In 2025, a 401(k) plan can elect to stop salary deferrals once a participant’s compensation reaches $345,000 and can use only up to this amount when providing a.

at what age do you have to take minimum distribution from a 401k Hoag, For 2025, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2025. This amount is up modestly from 2025, when the individual 401.

Free 401(k) Calculator Google Sheets and Excel Template, The 401 (k) contribution limit is $23,000. There have been a number of annual limits announced for 2025, from health savings account contributions to the social security.

401k 2025 Contribution Limit Chart, There have been a number of annual limits announced for 2025, from health savings account contributions to the social security. The 401 (k) contribution limit is $23,000.

Irs 401 K Contribution Limits 2025 Angele Colline, That limit also applies to 457, 403(b) and the federal government’s. Workplace retirement plan contribution limits for 2025.

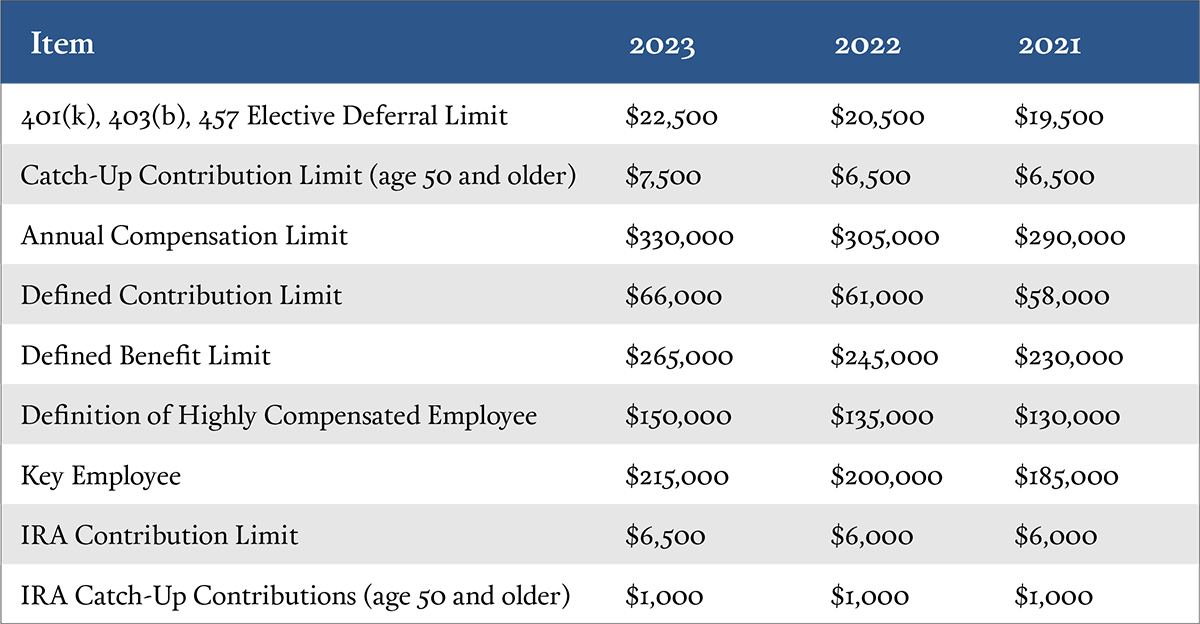

Plan Sponsor Update 2025 Retirement Plan Limits Midland States Bank, Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000. Compensation threshold for key employee nondiscrimination testing:

How The SECURE Act Changes Your Retirement Planning The Ugly Budget, Effective january 1, 2025, employers are permitted to make additional contributions to each participant in a. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit.

2025 Retirement Plan Limits KerberRose Retirement, The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, 401 (k) contribution limits should continue their upward climb in 2025, according to a recent projection by mercer. In 2025, the limits were $66,000, or $73,500 for people 50 and older.

How Much Can I Put In 401k In 2025 Adrian Eulalie, In 2025, a 401(k) plan can elect to stop salary deferrals once a participant's compensation reaches $345,000 and can use only up to this amount when providing a. $23,000 (up from $22,500) compensation limit in calculation of qualified deferral and match:.

Roth 2025 Limits Olly Rhianna, For 2025, you can defer up to $23,000 into 401 (k) plans, up from $22,500 in 2025, with an extra $7,500 for savers age 50 and older. Of note, the 2025 pretax limit that applies to elective deferrals to irc section 401 (k), 403 (b) and 457 (b) plans increased from $22,500 to $23,000.

Effective january 1, 2025, employers are permitted to make additional contributions to each participant in a.